SECURE DIGITAL CUSTOMER INTERACTIONS

Secure and seamless, from onboarding to credentialing to transacting

The world is changing faster than ever before, and that’s especially true for retail financial institutions. From volatile interest rates and the growth of neobanks to synthetic identities and deepfakes, banks and credit unions must account for these threats while they also craft better experiences for their employees and end-users.

Fortunately, with our suite of payments and identity products spanning everything from digital onboarding to card/credential issuance to secure transactions, Entrust is uniquely equipped to help financial institutions meet the moment by delivering a simpler, safer, and more valuable journey for customers and members. In fact, no other vendor can provide the breadth of products that Entrust has for securing and simplifying the entire customer/member lifecycle.

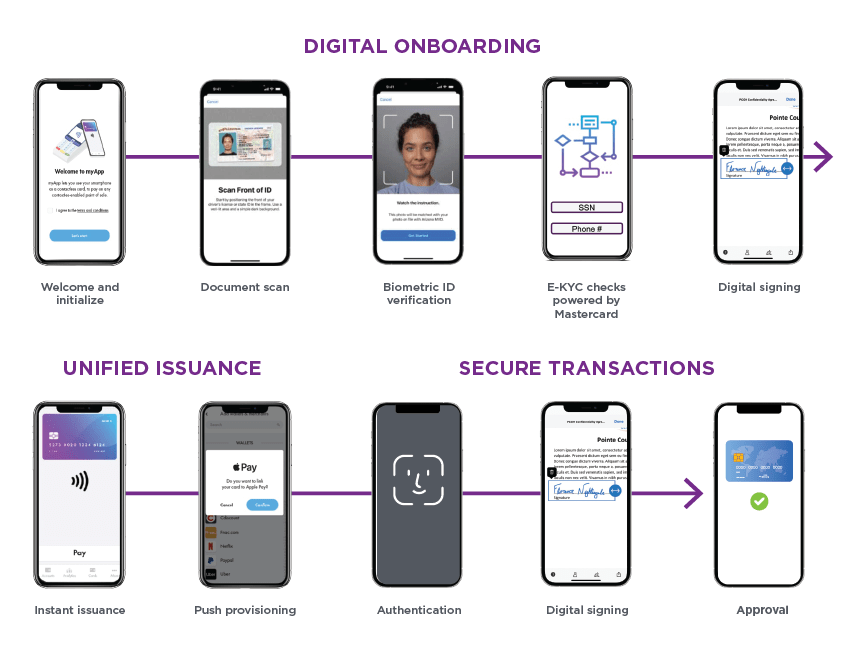

Digital Onboarding

When new customers sign up for a bank account, step one should be a seamless and secure digital onboarding process.

Entrust solutions for this step in the lifecycle include:

- Identity Verification

- Digital Signatures

- Identity as a Service

Unified Issuance

Entrust is an industry leader in financial card issuance for both fully featured digital and physical payment cards. No other organization provides both physical and digital credentialing like we do – with one unified workflow that creates a simpler, safer, more cost-effective issuance process.

Entrust solutions for this step in the lifecycle include:

- Physical card instant issuance (in branch or from a teller machine)

- Digital card instant issuance (on consumer’s mobile device)

- Physical card central issuance (delivered by mail)

Secure Transactions

Card security features and digital authentication tools help ensure your cardholders’ transactions are secure.

Entrust solutions for this step in the lifecycle include:

- Identity Verification

- Digital Signatures

- Identity as a Service

Key Capabilities

- End-to-end full lifecycle encryption

- Single-pane-of-glass reporting

- Biometric-enhanced e-KYC

- Risk-based decisioning and authentication

The Numbers

HOW TO BUILD LOYAL BANKING CUSTOMERS FROM DAY ONE

Too much friction when opening a new bank account online can stymie new customer and member acquisition. This ebook provides insights on how to streamline the onboarding process, enhance security, and ultimately secure top-of-wallet status.