Today’s consumers are used to digital and mobile experiences in their everyday lives and want seamless and digital services. Acceptance of digital payment is today a key selection criteria for customers. Banks need to offer their customers an instant and mobile-first banking experience. “Digital cards address this change in consumer behavior and enable instant card issuing on the consumer’s mobile device.” says Timothée Grüner, at Entrust (formerly Antelop Payments).

As a leading digital wallet, Apple Pay enables users to instantly get and digitize their cards in-app and perform face-to-face and online payments. iOS users now expect the service to be offered by their bank.

Banks that want to offer Apple Pay to their clients, also have to implement the mandatory in-app Apple Pay Push Provisioning of the card, directly from their banking app.

The Apple Pay Push is complex and expensive for banks to implement. A deep Visa / Mastercard tokenization expertise is required. This includes complex encryption and key management, specific mobile developments, overtime maintenance, … It also requires a certification by Apple to obtain.

The complexity is increasing with the number of schemes and use cases.

In general, processors do not offer a simplified implementation for Apple Pay Push including the mobile part.

That is why banks turn towards tokenization experts to get support with the implementation of Apple Push into their banking applications.

APPLE PUSH PROVISIONING WITH ENTRUST’S SDK OFFERS A CONVENIENT WAY TO PUSH DIGITAL CARDS INTO WALLETS

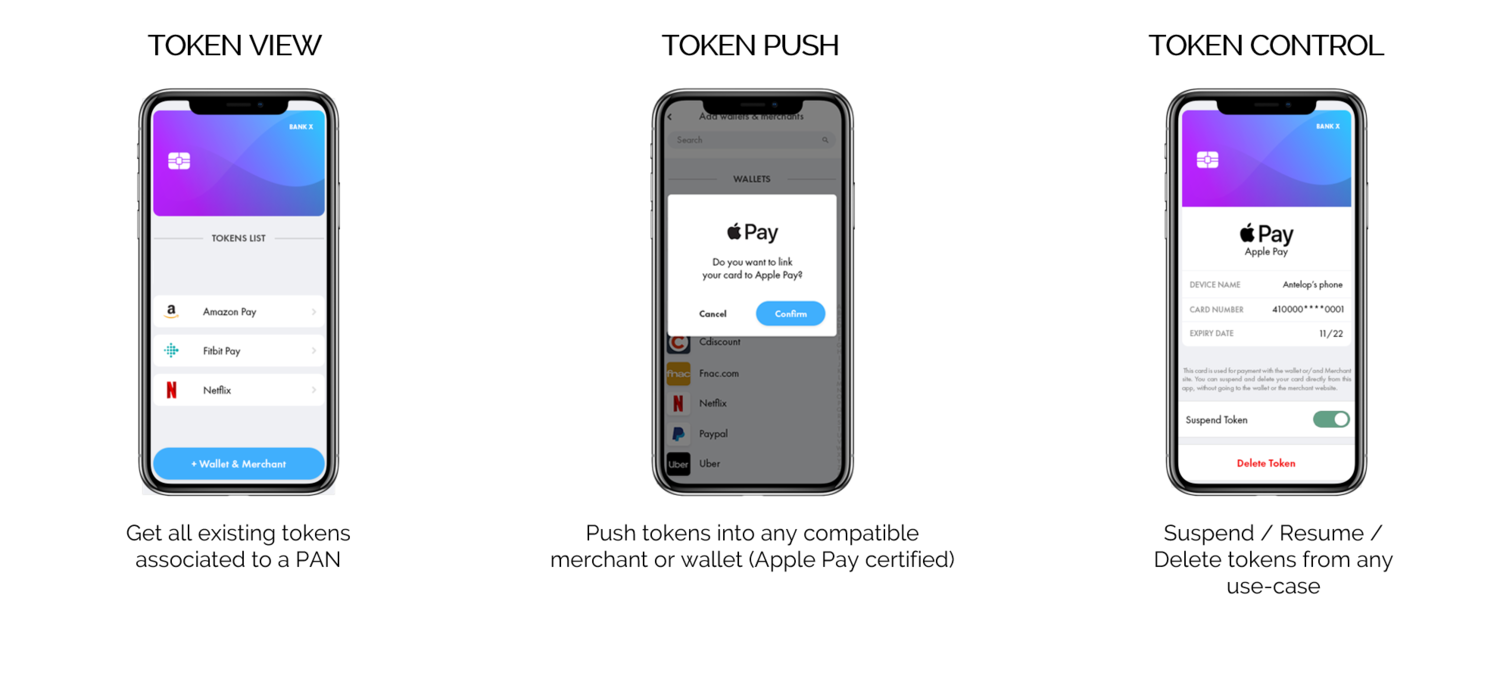

You can now enable users to directly push their cards from their app into third-party wallets, not only to Apple Pay, but also Google Pay, Garmin Pay, … and e-merchants!

PROVIDE A UNIFIED CUSTOMER EXPERIENCE TO YOUR CLIENTS

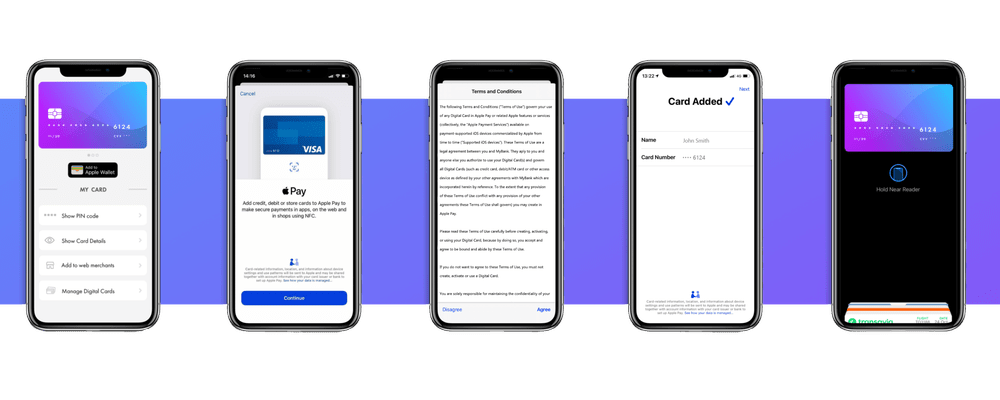

Apple Pay Push by Entrust enables your mobile banking users to securely push their Visa and Mastercard cards directly into Apple Pay wallet without step-up authentication needed, as already authenticated by the bank.

The solution also guarantees a holistic customer journey within the banking app for push provisioning into all compatible digital wallets or merchants. Users can now push any card into any use case, such as Apple Pay, Samsung Pay, Garmin Pay, FitBit Pay, Click-to-Pay and e-commerce merchants…

HERE’S HOW IT WORKS FOR YOUR CUSTOMERS FOR APPLE PAY:

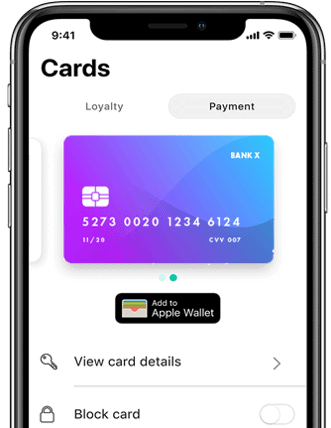

- In the banking app, click on “add to Apple Wallet”

-

Confirm notification

-

Biometric authentication

-

Accept terms and conditions (Apple Pay)

-

Wait for the card being added to the wallet

-

Done! You can now pay with your digital card in Apple pay (at POS or online) and manage the card in your banking app

Customers can make payments at online merchants or NFC payments at POS, but also manage their tokens and track their transaction history.

OUR APPLE PAY PUSH SERVICE OFFERS A HOLISTIC CUSTOMER EXPERIENCE FOR A PERFECTLY SIMPLIFIED PAYMENT JOURNEY.

-

Convenience and security – No need to manually enter the card details in the wallet app or on an e-commerce merchant website

-

Future-proof – based on Visa and Mastercard tokenization (compatible Debit, Credit and Prepaid and all card systems)

-

Push provisioning management in a unified way (multi-scheme/use-cases/multi-CMS) including PAN encryption and key management

The SDK by Entrust allows pushing cards to all X-Pays and e-commerce merchants: the solution is a secure mobile SDK that is embedded into the mobile application.

A UNIFIED AND SIMPLIFIED INTEGRATION OF PUSH PROVISIONING

Thanks to our unified PCI-DSS service (Apple Pay certified), the project and integration are simplified. The bank just needs to integrate our secure SDK with our support and follow the 3 following steps:

-

Initialize SDK: mobile app calls the SDK and shares a ClientID

-

Device binding: mobile app pushes an encrypted PAN or a CardID to be bound to that SDK

-

Push card: mobile app calls the SDK for pushing the card into any use case

Additionally to Apple Pay Push, we also provide token management functionalities, especially token view and control.

For more information about our Token Manager, please read here.

The Entrust One Digital Card SDK, natively supporting Apple Pay Push, enables one single integration for all digital card features. It is built on schemes’ services and integrates leading mobile security.

The ‘mobile-first’ integration mode is a change of paradigm for banks as no long back-end connection projects are required. Global maintenance is totally simplified and SDK upgrades transparently ensure latest innovations from schemes.